Cost Variance deals with the budget and actual cost of the project. It provides you with information on whether the project is over or under budget, in terms of money. It is a measure of the cost performance of a project. The project must be completed within the approved budget. Exceeding the planned budget is bad for all the stakeholders in the project.

Clients are very careful about spending because if any additional cost is spent above the budget, it will affect their profit. In the worst situation, more money is required to complete the project as per the contract. This is destructive if the contract is fixed price. To calculate the Cost Variance, Earned Value and Actual Cost is required.

Earned Value (EV)

Earned Value is the value of the work completed to date, it shall be calculated by multiplying “Performance % Complete” and “Budgeted Total Cost” for each activity.

Actual Cost (AC)

Actual Cost is the realized cost incurred for the work performed on an activity during a specific time. In other words, the cost incurred to accomplish the work for which Earned Value is measured.

Cost Variance (CV)

Cost Variance is a measure of the cost performance of a project.

The Formula for Cost Variance

Cost Variance can be calculated by subtracting the actual cost from the Earned Value.

Cost Variance = Earned Value – Actual Cost.

CV = EV – AC

We can conclude the following from the above formula:

If the Cost Variance is positive, the project is under budget.

If the Cost Variance is negative, the project is over budget.

If the Cost Variance is zero, the project is on the budget.

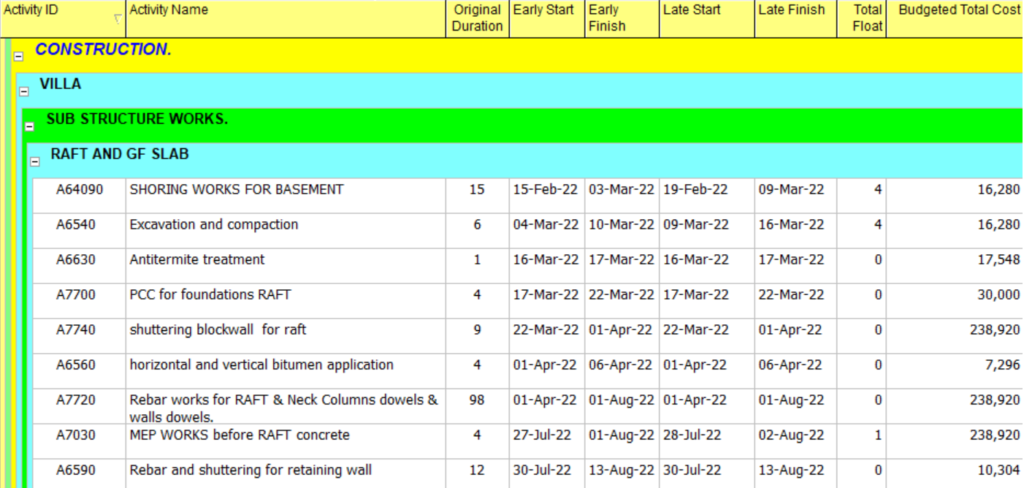

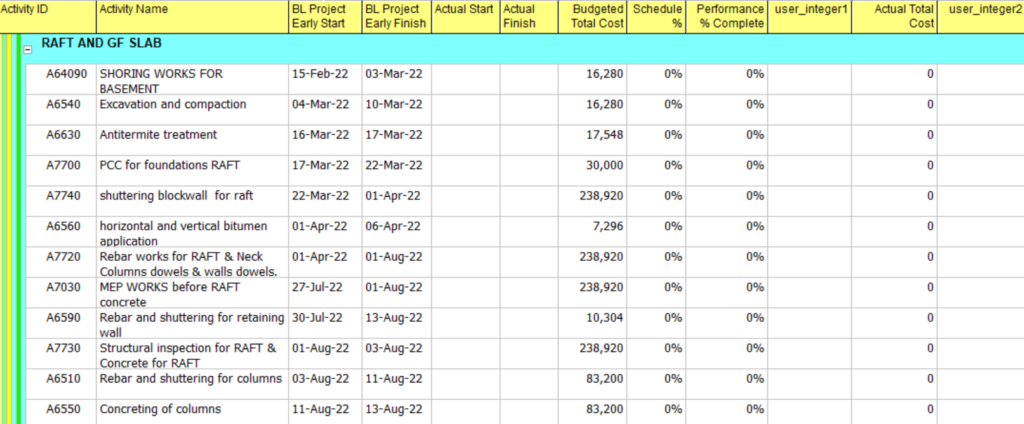

Cost loading for the Activities in Baseline Program

To Calculate Cost Variance (CV) from Primavera P6, the procedures to be followed are as below:

The Baseline Program is to be cost-loaded for the respective activities as per the Budgeted Cost.

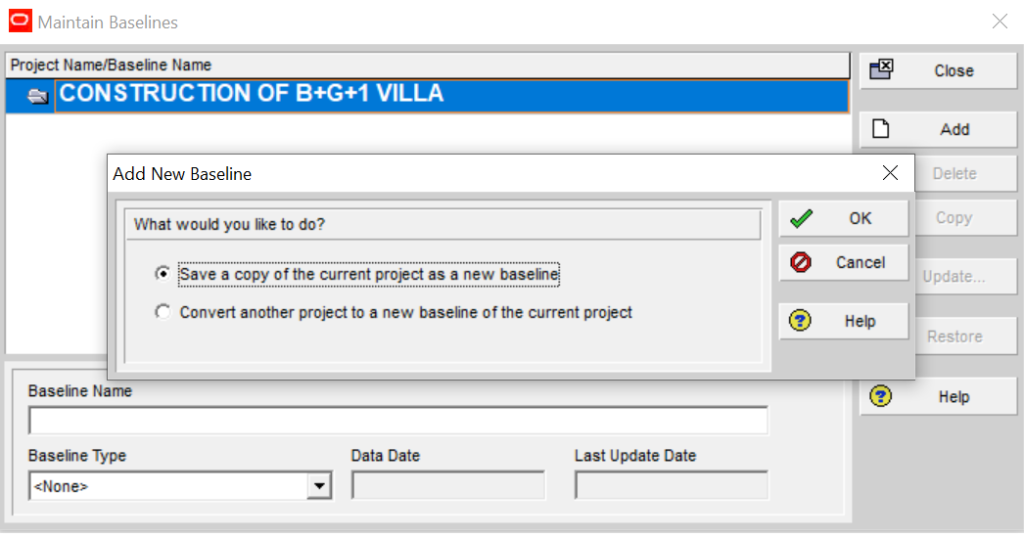

Adding and Assigning a Baseline to the program

To add a Baseline, we will click “Project,” and “Maintain Baselines.” The program navigates to the “Maintain Baselines” window, wherein we click “Add.” A dialogue box appears with two options, we will select the option “ save a copy of the current project as a new baseline” and click “OK.”

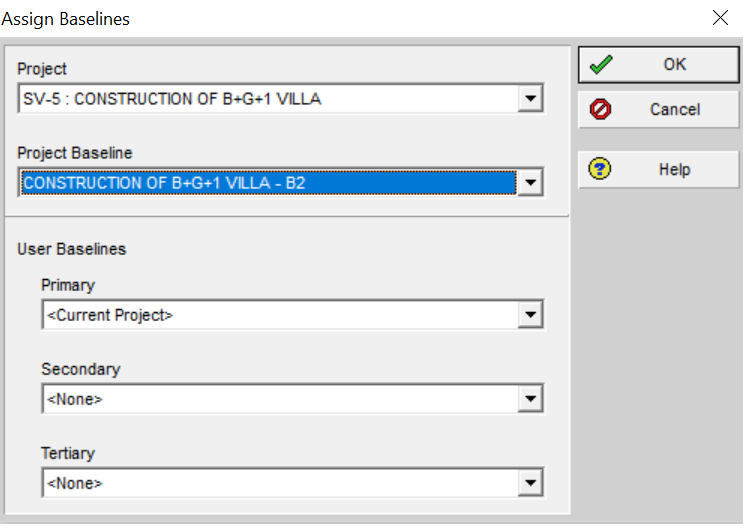

Once the baseline is added, we click “Assign Baselines,” select the baseline added in the previous step for “Primary Baseline” and click “OK.”

Adding Columns in the Program for update

Once the baseline is assigned, we will add the additional columns, user_integer1, and user_integer2 to include the “Earned Value,” and “Cost Variance” in the updated program.

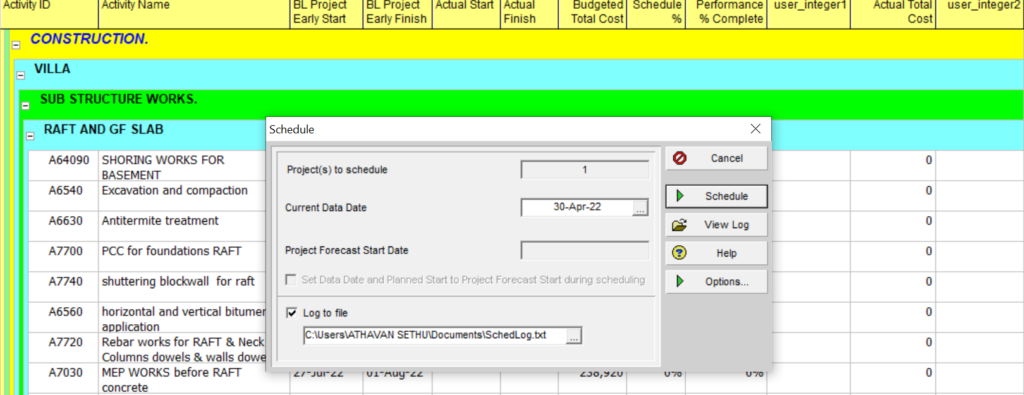

Updating the Program

To update the project, we need to schedule the program with a new “Data Date,” as per the progress cut-off date. For instance, we will consider the progress cut-off date as 30 April 2022 and schedule the program with 30 April 2022 as the “Data Date.”

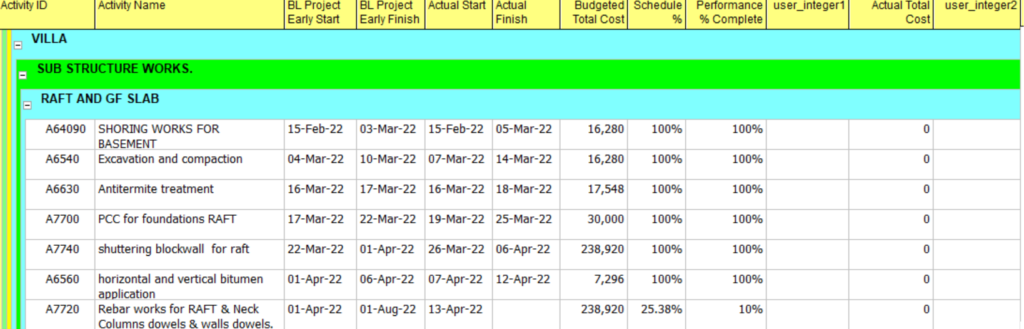

Then we will enter “Actual Start,”, ”Actual Finish,” and “Performance % complete” in the updated program

Calculating Earned Value

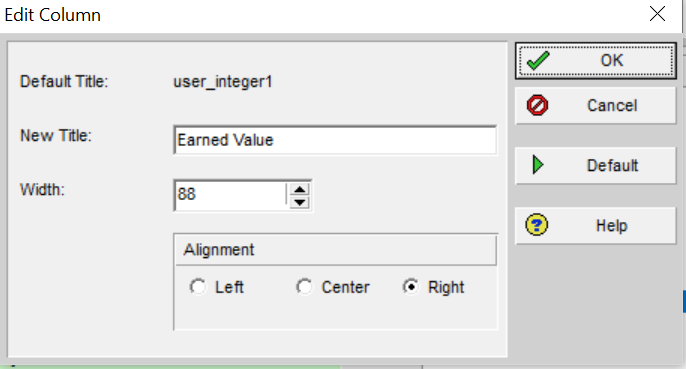

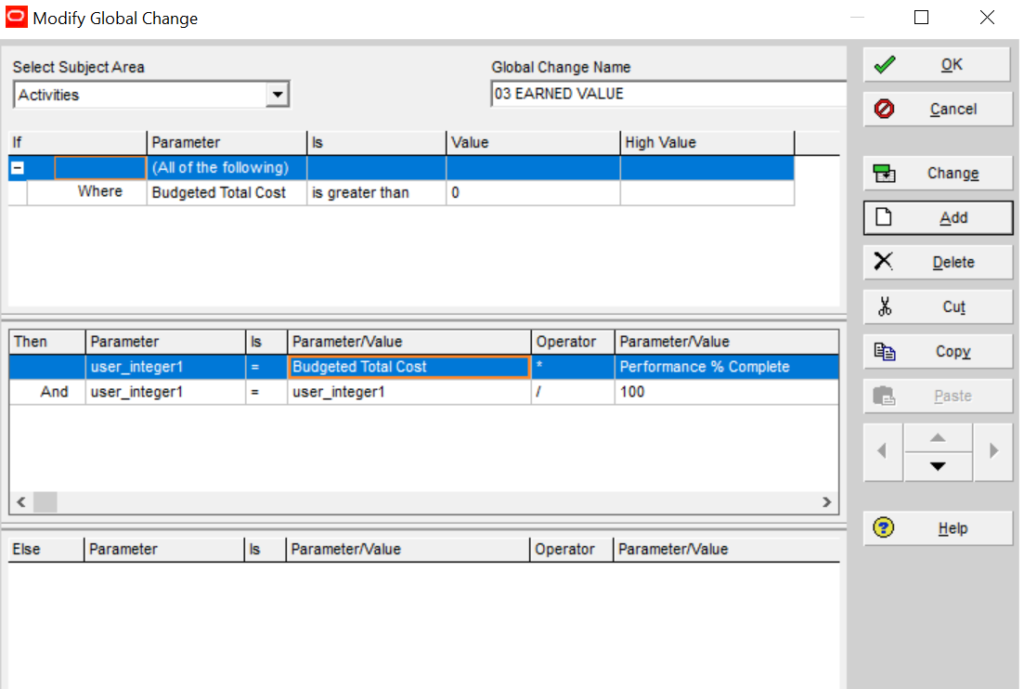

To calculate the “Earned Value,” we will rename the column “user_integer1” in the updated program as “Earned Value” and calculate the values using “Global Change” in Primavera P6 with the formula mentioned below.

Earned Value =( Performance % Complete x Budgeted Total Cost)/100

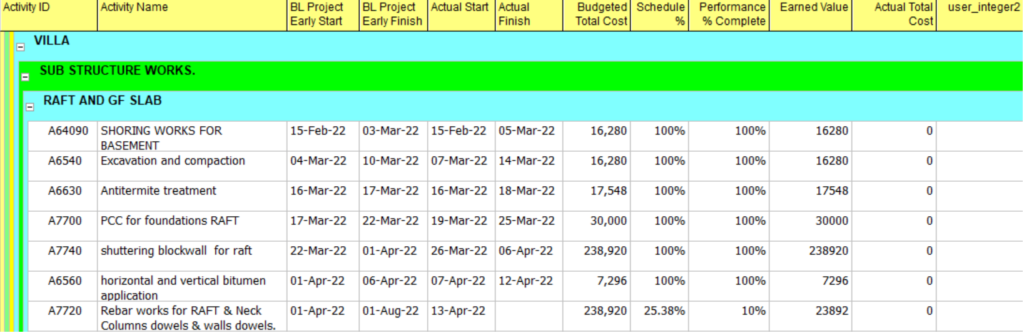

Once the above-mentioned global change is applied, the values for “Earned Value” is displayed in the updated program as shown in Figure 9 below.

Entering Actual Cost

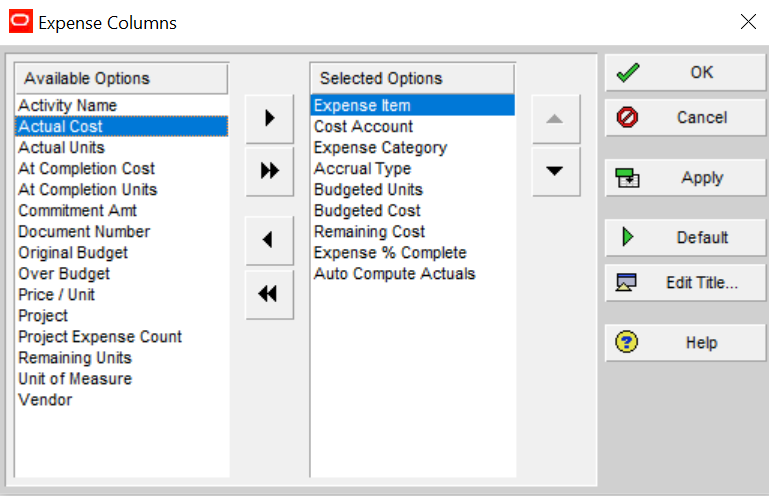

The next step is to enter the “Actual Cost” for the activities. To do this we will click the “Expenses” tab in “Activity Details,” right-click “Customize Expense Columns,” select “Actual Cost” from available options and click “Add to list” to move it to “Selected Options.”

Then we will enter the Actual Cost incurred to accomplish the work in the “Actual Cost” column of the “Expenses” tab for the completed activities and the activities in progress. Once the above-mentioned values are entered, the “Actual Cost” will be displayed in the updated program as shown in the figure below.

Calculating Cost Variance

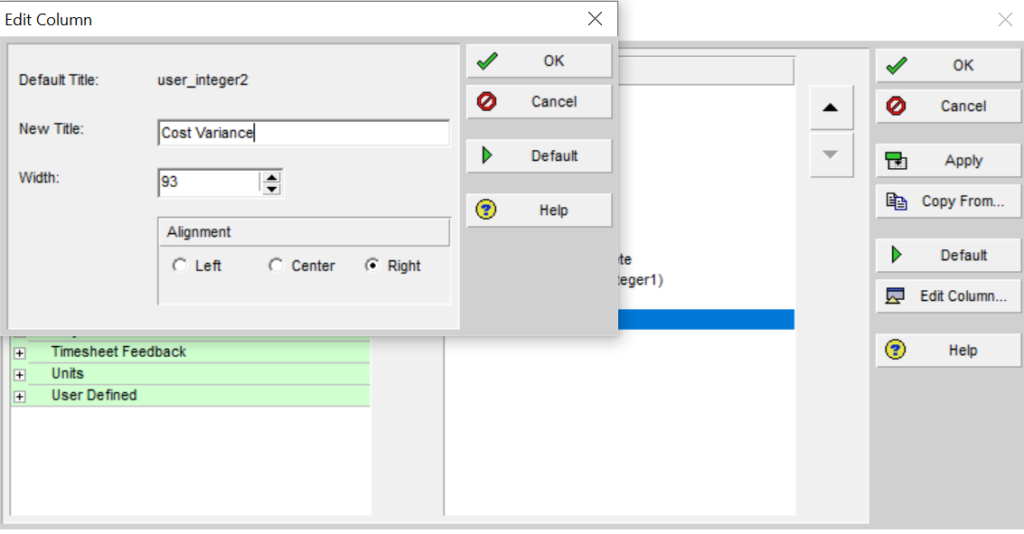

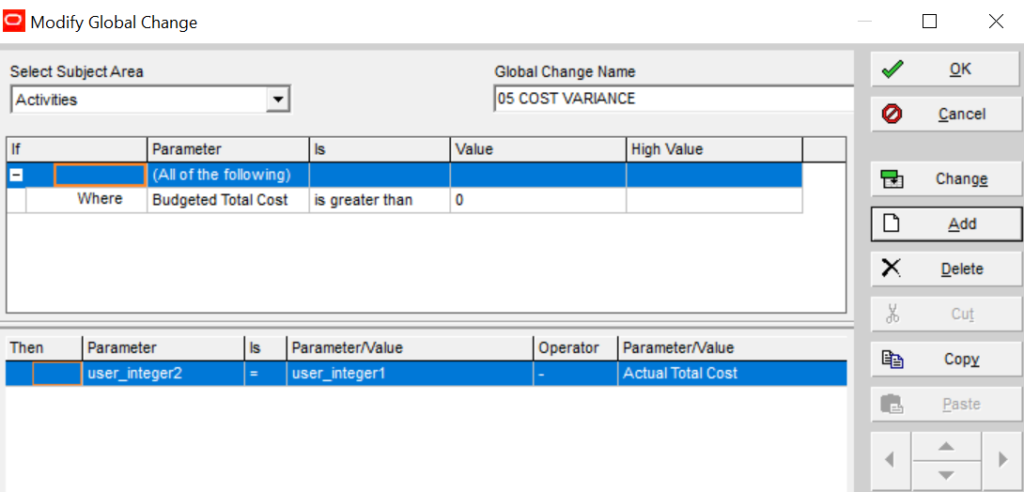

To calculate the “Cost Variance,” with respect to the “Earned Value,” and “Actual Cost,” we will rename the column “user_integer2 in the updated program as “Cost Variance” and calculate the values using “Global Change” in Primavera P6 with the formula as mentioned below.

Cost Variance (User integer 2) = Earned Value (User integer 1) – Actual Cost

Figure 12: Edit Column “user_integer2” as Cost Variance

Figure 12: Edit Column “user_integer2” as Cost Variance

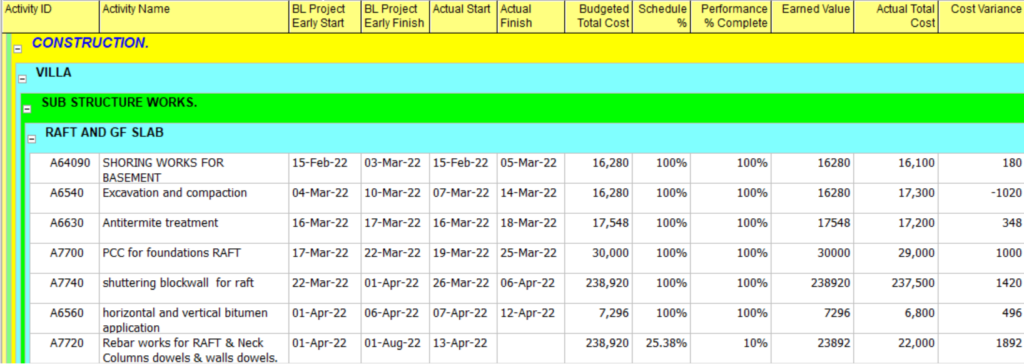

Once the above-mentioned global change is applied, the values for “Cost Variance” is displayed in the updated program for the completed activities and activities in progress as shown in the figure below.

In this illustration, the “Cost Variance” for all the activities are positive except the activity “Excavation and Compaction”. The actual cost of activities with positive “Cost Variance” is under budget. The “Cost Variance” for the activity “Excavation and Compaction” is negative, therefore the actual cost for this activity is above budget.

Conclusion:

Cost Variance (CV) is an important factor in Earned Value Management which is a useful tool to analyze the project’s progress with respect to the budget and actual cost. Cost Variance helps to determine whether the actual cost of the activity/WBS is under budget or over budget.

Cost Variance analysis helps to monitor the project performance, enabling us to take remedial action as soon as required and let us know if we are going in the correct direction or not.